Marginal lending facility (MLF)

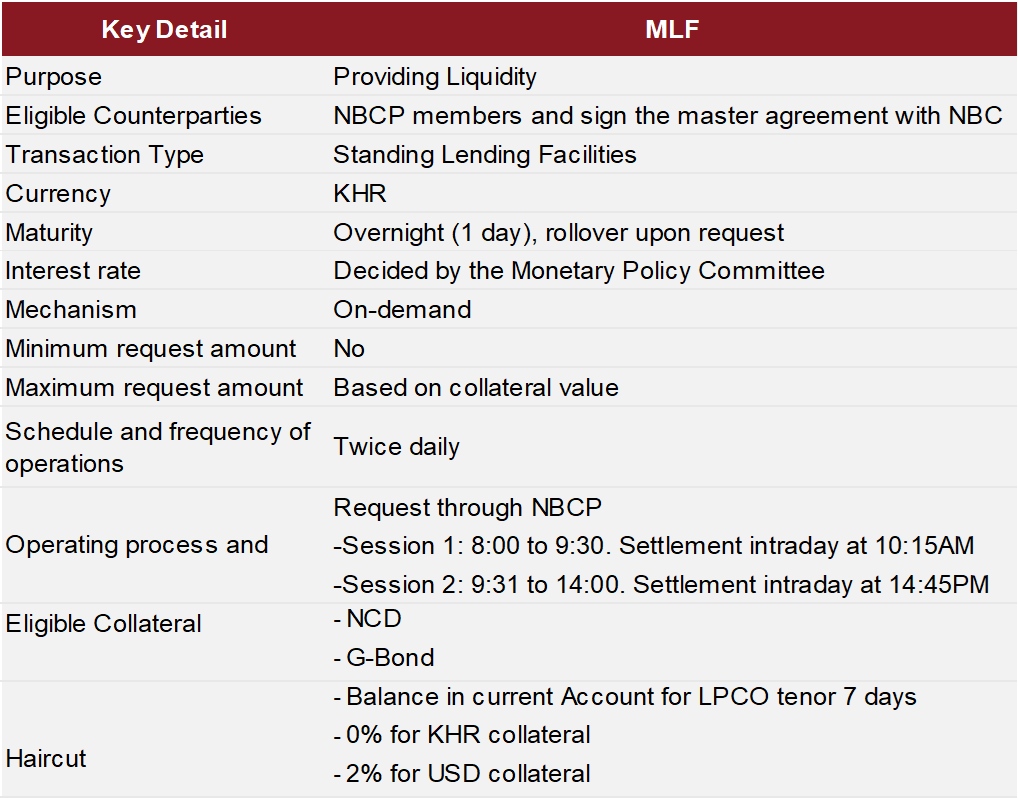

The Marginal Lending Facility (MLF) provides short-term liquidity needs to financial institutions at moment of needs with a fixed interest rate and has one day maturity (overnight), which can be extended upon request. The MLF is operated every business day which facilitates the efficient management of liquidity in KHR. The amount provided is based on the request and depends on the collaterals. The collaterals are negotiable certificates of deposit (NCDs) or government bonds.

The liquidity provides through MLF can be obtained within 45 minutes after the end of each sessions (open twice a day, morning or afternoon). The MLF supports financial institutions to access and manage liquidity in KHR more efficiently and helps maintaining interest rate stability.

⁘ Institutions that are not members of the NBCP must fulfill the conditions as below:

1. Submit a request form for NBC Platform (NBCP) membership.

2. Sign the master agreement with the National Bank of Cambodia.

⁘ Announcement and related documents:

| Date | Related Document | Download File |

|---|---|---|

| 13 Mar 2025 | Announcement on the Implementation of Marginal Lending Facility-MLF |

|

| 17 Oct 2023 | Announcement on new interest rate set for MLF |

|

| 13 Sep 2021 | Announcement on Launching of Marginal Lending Facilities-(MLF) |

|

| 19 Oct 2009 | Prakas on the implementation of the master agreement for repurchased operations to promote interbank transactions in monetary market. |

|