Monetary Operations Framework

The National Bank of Cambodia influences the target rate in interbank markets by setting the reference rate on monetary instruments and managing liquidity in banking system. NBC manages the liquidity in banking system by using open market operations, issuing central bank bills, reverse repurchase agreements (repo), and providing short-term liquidity. The NBC set reference rate by using the rate of 7 days Liquidity Providing Collateralized Operations (LPCO). NBC also implements monetary policy by intervening foreign exchange markets and setting the reserve requirements rates.

Currently, Negotiable Certificates of Deposit (NCD) play roles as central bank bills that use to absorb excess liquidity from banking system. Meanwhile, Liquidity Providing Collateralized Operations (LPCO) are reverse repo operations that use to inject liquidity into the banking system. In addition, NBC provides short-term liquidity through the Marginal Lending Facility (MLF), a tool designed to provide liquidity at moment of need, facilitating more efficient liquidity management in Khmer Riel. The MLF offers overnight lending which can be extended upon request. These tools have been put into use and have important roles in enhancing the effectiveness of monetary policy, developing interbank markets, and promoting the use of Khmer Riel.

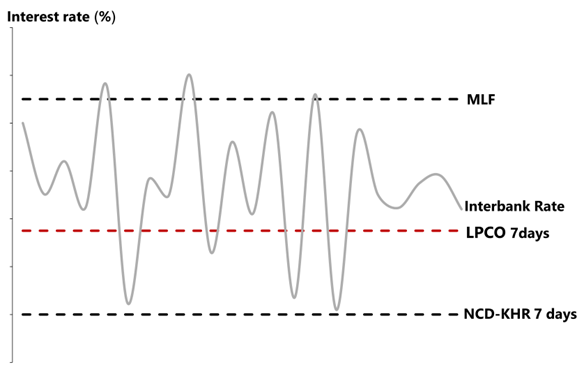

As a mechanism to manage interest rates in the interbank market, NBC has introduced an Interest Rate Corridor (IRC) framework, which is composed of the ceiling rate, the reference rate, and the floor rate. These rates are directly offered by the NBC in liquidity-providing and liquidity-absorbing operations and serve as the benchmark for financial institutions to set the rates for short-term lending in the interbank market.

Marginal Lending Facility (MLF) is a tool for setting the ceiling interest rate. Meanwhile, the Liquidity Providing Collateralized Operation (LPCO) 7 days tenor, reverse repo operations, is used as the reference rate. Lastly, the Negotiable Certificate of Deposit (NCD) 7 days tenor are central bank bills that set the minimum interest rate.

The reference rate is the key interest rate set by the central bank as target for the interbank market rates. The NBC adjusts these rates to support economic activities, such as increasing the interest rate when inflation is high or KHR is depreciated, or vice versa, to sustain steady growth.

Benefits of Using the Interest Rate Corridor (IRC)

- Maintaining interest rate stability: By setting clear and transparent interest rates, the interest rate corridor provides a framework that reduces uncertainty and volatility of interest rates in the interbank market. It ensures that interest rates remain within a predefined range as determined by the Monetary Policy Committee.

- Improving liquidity management in Khmer Riel: The interest rate corridor also introduced instruments that facilitate the management of excess liquidity, enhancing the ability to absorb or inject liquidity more effectively. This mechanism helps to reduce the amount of reserves that financial institutions need to hold for daily operations, thus smoothening the demand for liquidity and reducing the volatility of interest rates in Khmer Riel.