Liquidity Providing Collateralized Operation (LPCO)

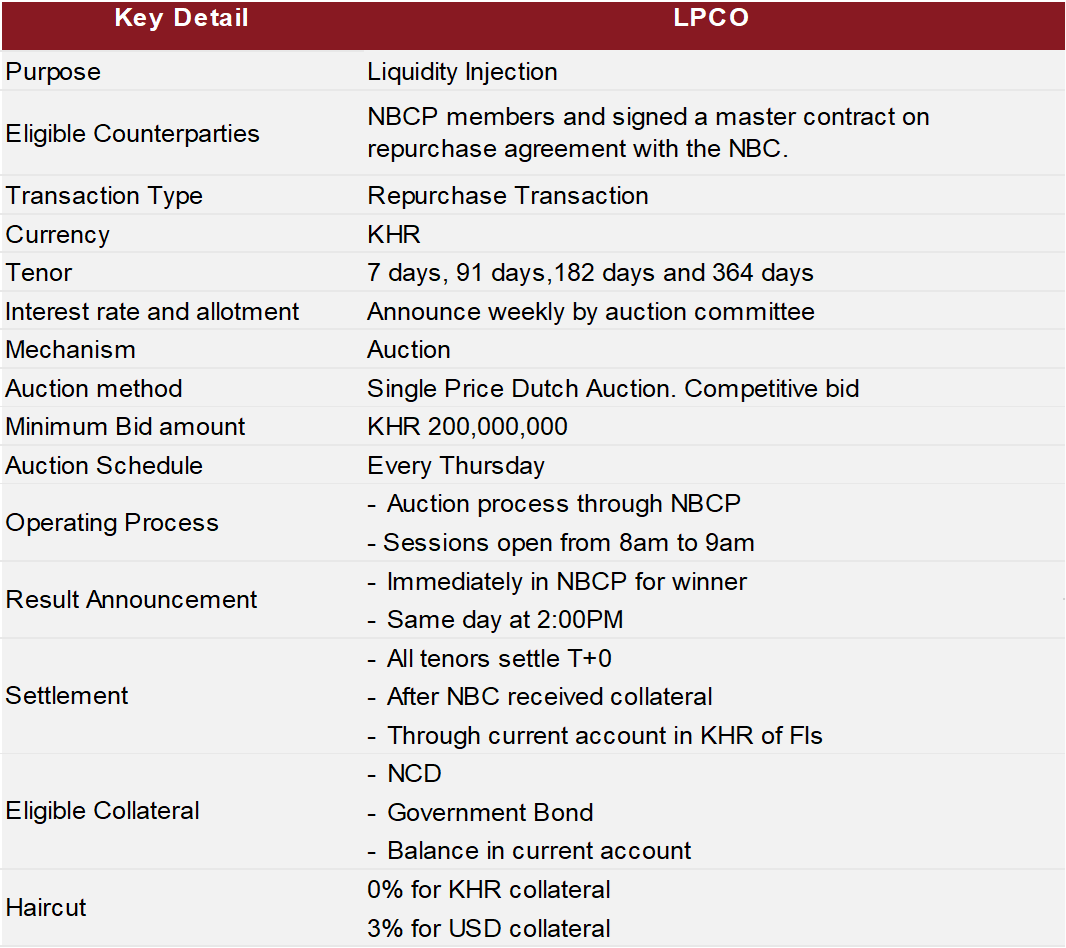

The LPCO operations is a repurchase agreement (Repos) transaction of the National Bank of Cambodia used to provide liquidity in Khmer Riel to financial institutions in order to facilitate the management of liquidity and promote the use of Khmer Riel. Financial institutions can use Negotiable Certificate of Deposit (NCD), Government securities and Current Account as collateral.

The NBC determines the amount and minimum interest rate for LPCO’s weekly auction. Financial institutions that are members of the National Bank of Cambodia Platform (NBCP) can participate through the NBCP auction by providing information on the bidding amount and the interest rate.

Auction is conducted in the form of competitive bids, where all investors bid interest rates are sorted from high to low as a basis to determine the winner. The number of winners depends on the total allotment amount and the remaining amount after the successful bidders are awarded. In addition, the interest rate will be determined by the single-price auction, which is the lowest bidding rate among the successful bidders. The winning bidder will be notified through the NBCP and must prepare collaterals for the predetermined settlement time.

⁘ Institutions that are not members of the NBCP must fulfill the conditions as below:

1. Submit a request form for NBC Platform (NBCP) membership.

2. Sign a master contract on repurchase agreement with the National Bank of Cambodia.